Dec 09 2011

Weekly Digest – 12/09/11

Our weekly edition is a nationally syndicated one-hour digest of the best of our daily coverage.

Audio Stream |

Audio Stream | ![]() Podcast | Mp3 Download

Podcast | Mp3 Download

This week on Uprising:

* What’s Behind the Payroll Tax Extension?

* The Politics of the Eurozone Crisis and European Popular Outrage

* Nomi Prins’ New Novel Black Tuesday, Highlights History of 1929 Stock Market Crash

* * *

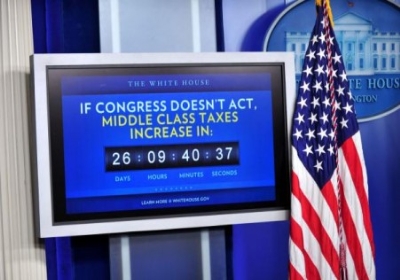

What’s Behind the Payroll Tax Extension?

Democrats and Republicans are locked in a bitter battle over extending for another year the Payroll tax holiday. Payroll taxes fund Social Security and, to an extent, Medicare. If Congress doesn’t act before the end of the year, the taxes paid toward Social Security from people’s paychecks would increase from 4.2% to 6.2%. On the one hand payroll taxes aren’t really taxes – they are premiums paid toward a benefit that Americans expect to collect later in life. On the other hand, a suddenly decreased paycheck in these tough times can only hurt the economy. A deal offered to the Senate by Democrats earlier this week to extend the tax holiday was rejected by Republicans. That deal, called the Collins-McCaskill proposal, included a surtax on individuals making over $1 million a year, and an end to tax breaks for the five biggest oil companies – both of these are ideas that are highly popular across the political spectrum of Americans. However, critics of the Democrats’ approach say there are far more efficient ways to stimulate the economy than going after payroll taxes. Firstly, people making more than $106,000 a year save more than $3000 a year with the tax holiday, while people making $20,000 a year, save only a few hundred dollars, according to my guest Richard Eskow of the Campaign for America’s Future – this makes it an economically regressive policy. Secondly, Social Security, which is already under attack based on spurious claims of it facing bankruptcy, will be weakened by reducing the taxes that fund it. Thirdly, the payroll tax holiday also reduces employer contributions to payroll taxes, but most employers are hardly financially fragile – American businesses have trillions of dollars of cash reserves. President Obama has been campaigning for the payroll tax holiday, most recently in Osawatomie, Kansas where he spoke on Tuesday, invoking Teddy Roosevelt’s famous “New Nationalism” speech over a hundred years ago.

Democrats and Republicans are locked in a bitter battle over extending for another year the Payroll tax holiday. Payroll taxes fund Social Security and, to an extent, Medicare. If Congress doesn’t act before the end of the year, the taxes paid toward Social Security from people’s paychecks would increase from 4.2% to 6.2%. On the one hand payroll taxes aren’t really taxes – they are premiums paid toward a benefit that Americans expect to collect later in life. On the other hand, a suddenly decreased paycheck in these tough times can only hurt the economy. A deal offered to the Senate by Democrats earlier this week to extend the tax holiday was rejected by Republicans. That deal, called the Collins-McCaskill proposal, included a surtax on individuals making over $1 million a year, and an end to tax breaks for the five biggest oil companies – both of these are ideas that are highly popular across the political spectrum of Americans. However, critics of the Democrats’ approach say there are far more efficient ways to stimulate the economy than going after payroll taxes. Firstly, people making more than $106,000 a year save more than $3000 a year with the tax holiday, while people making $20,000 a year, save only a few hundred dollars, according to my guest Richard Eskow of the Campaign for America’s Future – this makes it an economically regressive policy. Secondly, Social Security, which is already under attack based on spurious claims of it facing bankruptcy, will be weakened by reducing the taxes that fund it. Thirdly, the payroll tax holiday also reduces employer contributions to payroll taxes, but most employers are hardly financially fragile – American businesses have trillions of dollars of cash reserves. President Obama has been campaigning for the payroll tax holiday, most recently in Osawatomie, Kansas where he spoke on Tuesday, invoking Teddy Roosevelt’s famous “New Nationalism” speech over a hundred years ago.

GUEST: Richard Eskow, Consultant, writer, and Senior Fellow with the Campaign for America’s Future

Read Richard Eskow’s article about the payroll tax cut extension here: http://www.huffingtonpost.com/rj-eskow/the-long-game-payroll-tax_b_1119408.html

The Politics of the Eurozone Crisis and European Popular Outrage

European leaders gathered for a summit in Brussels this week in last-ditch efforts to solve the Eurozone crisis. French President Nicolas Sarkozy commented that failure was a “luxury we cannot afford.” On Friday, the day this program was recorded, member nations of the Eurozone were expected to vote on a plan drafted by Sarkozy and German Chancellor Angela Merkel. They propose amending treaties that govern EU finances, demanding more rigorous budget management from members. European Commission president Herman Van Rompuy has offered an alternative approach that includes the punitive measure of barring a member nation from voting if it receives a bail-out and then fails to keep its deficit under 3% of national GDP. EU officials are also looking into an early launch of a new 500 billion euro bail-out fund, the European Stability Mechanism (ESM), initially slated to replace the old structure, the European Financial Stability Facility (EFSF) in 2012. The two funds will likely now be used together. The International Monetary Fund (IMF) may also lend money to cash strapped EU nations. Disagreement over the details of any one plan is not the only obstacle to an EU consensus in negotiations. British Prime Minister David Cameron said he will not sign anything until safeguards are in place to ensure the EU does not gain any more power over Britain’s financial system. Meanwhile, the credit ratings agency Standard and Poors has placed 15 AAA rated EU countries, including France and Germany, on review, threatening a downgrade. Observers say such a move would create panic among investors, plunging the already gloomy situation in Europe into further chaos. And this week the European Central Bank announced it will cut interest rates for a second month in a row to try to stave off a credit crunch.

European leaders gathered for a summit in Brussels this week in last-ditch efforts to solve the Eurozone crisis. French President Nicolas Sarkozy commented that failure was a “luxury we cannot afford.” On Friday, the day this program was recorded, member nations of the Eurozone were expected to vote on a plan drafted by Sarkozy and German Chancellor Angela Merkel. They propose amending treaties that govern EU finances, demanding more rigorous budget management from members. European Commission president Herman Van Rompuy has offered an alternative approach that includes the punitive measure of barring a member nation from voting if it receives a bail-out and then fails to keep its deficit under 3% of national GDP. EU officials are also looking into an early launch of a new 500 billion euro bail-out fund, the European Stability Mechanism (ESM), initially slated to replace the old structure, the European Financial Stability Facility (EFSF) in 2012. The two funds will likely now be used together. The International Monetary Fund (IMF) may also lend money to cash strapped EU nations. Disagreement over the details of any one plan is not the only obstacle to an EU consensus in negotiations. British Prime Minister David Cameron said he will not sign anything until safeguards are in place to ensure the EU does not gain any more power over Britain’s financial system. Meanwhile, the credit ratings agency Standard and Poors has placed 15 AAA rated EU countries, including France and Germany, on review, threatening a downgrade. Observers say such a move would create panic among investors, plunging the already gloomy situation in Europe into further chaos. And this week the European Central Bank announced it will cut interest rates for a second month in a row to try to stave off a credit crunch.

Meanwhile the European Metalworkers Federation announced that thousands of workers were on strike on Thursday across the European plants of the world’s largest steel manufacturer, ArcelorMittal. More than 25,000 workers are launching twenty four hour work stoppages in protest of job insecurity, leading to production shortfalls of 10-20%. The strike comes just days after Britain saw its biggest strike in decades against cuts to pensions. An estimated 2 million people walked off their jobs for a massive strike on November 30th, striking against austerity measures proposed by the Government. Teachers, civil servants, nurses and construction workers were among those who gathered in cities around the nation to fight proposed measures that would raise the retirement age and require larger contributions to pensions. And on Friday, the staff of Unilever in London, for the first time in their history, went on strike to protest plans to scrap their pensions. British parliamentary support for austerity measures mirrors a growing consensus among EU heads of state that the Eurozone crisis demands spending cuts.

GUEST: Will Straw, Associate Director at the Institute for Public Policy Research

Visit www.ippr.org for more information.

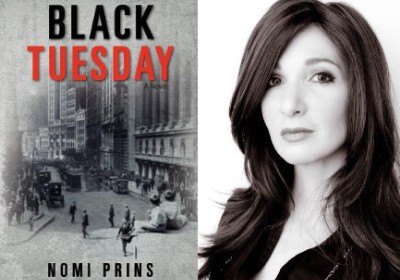

Nomi Prins’ New Novel Black Tuesday, Highlights History of 1929 Stock Market Crash

In his speech invoking Teddy Roosevelt’s New Nationalism, President Obama this week referred numerous times to the Great Depression. Comparing today’s economic crisis to the American era that began in 1929 and was the longest recession in modern history, Obama brought up his own grandparents’ experiences and attempted to make the case that an unregulated market does not fix itself – it didn’t do it during the Great Depression and cannot be relied on to fix itself without government intervention today. Much is made of the historical comparison with the Great Depression and today’s Great Recession, and today we go back in time to the months that led up to the stock market crash of October 29, 1929 with economist and best-selling author Nomi Prins to discuss her debut fiction work, Black Tuesday. Black Tuesday is the story of Leila Kahn, a young Eastern European immigrant in New York who falls in love with Roderick Morgan, JP Morgan’s grand nephew while the depth of the economic crisis unfolds. Leila learns the shocking truth of the coverup behind the 1929 stock market crash.

In his speech invoking Teddy Roosevelt’s New Nationalism, President Obama this week referred numerous times to the Great Depression. Comparing today’s economic crisis to the American era that began in 1929 and was the longest recession in modern history, Obama brought up his own grandparents’ experiences and attempted to make the case that an unregulated market does not fix itself – it didn’t do it during the Great Depression and cannot be relied on to fix itself without government intervention today. Much is made of the historical comparison with the Great Depression and today’s Great Recession, and today we go back in time to the months that led up to the stock market crash of October 29, 1929 with economist and best-selling author Nomi Prins to discuss her debut fiction work, Black Tuesday. Black Tuesday is the story of Leila Kahn, a young Eastern European immigrant in New York who falls in love with Roderick Morgan, JP Morgan’s grand nephew while the depth of the economic crisis unfolds. Leila learns the shocking truth of the coverup behind the 1929 stock market crash.

Nomi Prins is a journalist and Senior Fellow at Demos. Her latest book is a dramatic historical novel about the 1929 crash, Black Tuesday. Her last book was It Takes a Pillage: Behind the Bonuses, Bailouts, and Backroom Deals from Washington to Wall Street (Wiley, September, 2009/October 2010). She is also the author of Other People’s Money: The Corporate Mugging of America (The New Press, October 2004), a devastating exposé into corporate corruption, political collusion and Wall Street deception.

Visit her website at www.nomiprins.com.

Sonali’s Subversive Thought for the Day

“Advocates of capitalism are very apt to appeal to the sacred principles of liberty, which are embodied in one maxim: The fortunate must not be restrained in the exercise of tyranny over the unfortunate.” — Bertrand Russell

Comments Off on Weekly Digest – 12/09/11