Feb 10 2012

Weekly Digest – 02/10/12

Our weekly edition is a nationally syndicated one-hour digest of the best of our daily coverage.

Audio Stream |

Audio Stream | ![]() Podcast | Mp3 Download

Podcast | Mp3 Download

This week on Uprising:

* Analysts Find Bank Foreclosure Settlement Wholly Inadequate

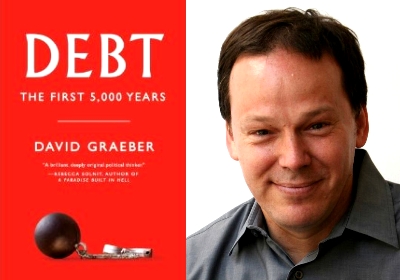

* Debt: The First 5000 Years – an In-Depth Interview with David Graeber

* * *

Analysts Find Bank Foreclosure Settlement Wholly Inadequate

Following this week’s announcement that 49 state Attorneys General reached a $25 billion deal with 5 major mortgage lenders, a Forbes headline read, “Mortgage Deal: Little Impact for Big Banks.” The assessment that banks got off easy in the foreclosure fraud settlement was a consensus among analysts. The settlement sought redress for people who were victims of robo-signing and other rushed methods of foreclosure. State officials and federal agencies that negotiated it, though, declared victory. The Secretary of the Housing and Urban Development agency said on Thursday, “[the settlement] isn’t just about punishing the banks… It’s also about requiring them to help the people they harmed.”

Following this week’s announcement that 49 state Attorneys General reached a $25 billion deal with 5 major mortgage lenders, a Forbes headline read, “Mortgage Deal: Little Impact for Big Banks.” The assessment that banks got off easy in the foreclosure fraud settlement was a consensus among analysts. The settlement sought redress for people who were victims of robo-signing and other rushed methods of foreclosure. State officials and federal agencies that negotiated it, though, declared victory. The Secretary of the Housing and Urban Development agency said on Thursday, “[the settlement] isn’t just about punishing the banks… It’s also about requiring them to help the people they harmed.”

However financial watchdogs concluded the deal would neither punish the banks nor be of much benefit to homeowners. Of the $25 billion being touted as a bank-payout, only $5 billion will come as cash from 5 financial institutions, a sum most analysts assume the banks already have in reserves. David Dayen at FireDogLake.com wrote,” [i]t’s a drop in the bucket compared to the negative equity in the county, which stands at around $700 billion.” About $17 billion will come from shareholders, including average Americans whose retirement money is tied up in mortgage backed securities.

The average pay-out to a homeowner, about $2000, is also being decried as pathetically small. Yves Smith at Naked Capitalism said the amount, “[i]s a fraction of the cost of legal expenses when foreclosures are challenged.” The lead negotiator, Iowa Attorney General Tom Miller, defended the deal as better than nothing, saying, “The homeowner that couldn’t get one dollar and they’re getting a check for $1500, they’re not going to tell us we settled too cheap.”

Of the 4 million homes lost to foreclosure since the financial crash, a large number of which were fraudulent, only about 750,000 borrowers who lost their homes between September 2008 and December 2010 will receive any money. Individuals retain the ability to sue their mortgage lender under the settlement, but states and many federal agencies gave up their right to pursue further legal action. Even President Obama was measured in his remarks on the settlement on Thursday, calling it a “start” and saying he hoped it would provide a “small measure” of relief to homeowners.

GUEST: Richard J. Eskow, Consultant, writer, and Senior Fellow with the Campaign for America’s Future, David Dayen, Politics Writer for FireDogLake.com

Read Richard J Eskow’s latest article about the foreclosure settlement here.

Read David Dayen’s latest article about the foreclosure settlement here.

Debt: The First 5000 Years

Most Americans know too well the unjust difference between how homeowners facing foreclosure have been treated, versus how massive indebted banks culpable for the economic crisis have been treated. That unequal application of justice has angered so many Americans, that it gave rise to a nationwide, and to an extent, worldwide movement under the banner of Occupy Wall Street. David Graeber is considered one of the first activists credited with getting Occupy Wall Street off the ground last year.

David Graeber’s earlier books include Towards and Anthropological Theory of Value, Lost People: Magic and the Legacy of Slavery in Madagascar, Fragments of an Anarchist Anthropology, and more. He also writes for Harper’s, the Nation, and the New Left Review.

Sonali’s Subversive Thought for the Day

“As it turns out, we don’t “all” have to pay our debts. Only some of us do. Nothing would be more important than to wipe the slate clean for everyone, mark a break with our accustomed morality, and start again.” – David Graeber.

Comments Off on Weekly Digest – 02/10/12